Business Loan

For business loans, finding the right solution is crucial. Consult a knowledgeable expert to secure the best loans for your business.

Business Loan

For business loans, finding the right solution is crucial. Consult a knowledgeable expert to secure the best loans for your business.

Applying for Business Loans: Elevate Your Business.

Business growth and challenges both require cash. Obtaining the best business loans provides the necessary resources to seize opportunities and address issues.

Securing a small business loan, instead of selling equity, enables you to retain ownership, profits, and control over your business. With numerous fast loan options available, finding the right one for your future investment can be overwhelming.

That's where our lender marketplace, with over 75 options, comes in - it presents all your options in one place and provides expert guidance for comparison, saving you time and effort by allowing you to apply only once.

The application process is fast, straightforward, and doesn't impact your credit score.

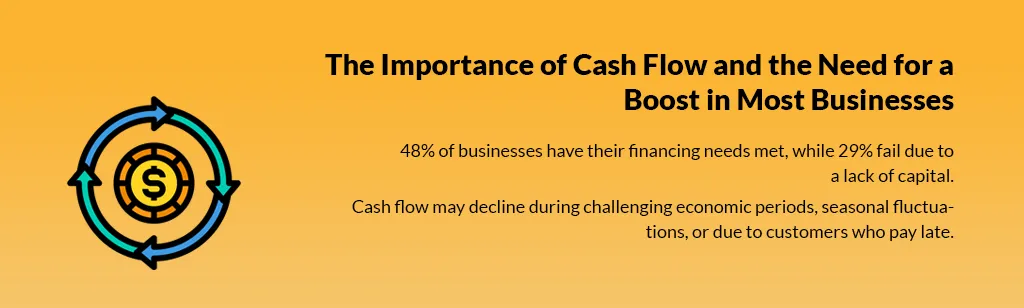

The Importance of Cash Flow and the Need for a Boost in Most Businesses

Cash flow is essential for the survival of a business, and small business loans provide a means to increase it.

A steady flow of cash enables you to meet all crucial business expenses, such as salaries, operating costs, and other payments.

Moreover, adequate cash flow opens up opportunities for business growth and expansion.

All businesses eventually encounter cash flow difficulties such as seasonal reductions and delayed payments from customers. Traditional financing options like business credit cards and personal loans may not offer sufficient funds to meet your needs. This could lead to difficulties in:

Employee salaries

New employee hiring

Inventory expenses

Office rent/mortgage payments

Supply expenses

Operating costs financing

Utility bills

Tax payments

Having adequate working capital is crucial for maintaining your business's growth and staying ahead of competitors, rather than falling behind.

Accelerating Business Growth with Efficient Business Financing

Growing a business is a desire for every owner, but it demands funds. The three options to achieve this growth are: reinvesting profits, securing equity, or obtaining a small business loan or alternative financing. Initially, reinvesting profits may seem cost-effective, but it can take considerable time to reach your desired growth due to limited working capital to cover expenses.

Small business loans for startups and other ventures can be more beneficial in the long term. They provide immediate access to funding for growth expenses, helping to quickly increase revenue.

The Process for Obtaining Small Business Loans

Quickly Compare Loan Offers from Various Lenders!

1. APPLY & CONNECT

Finish our online application

with just a few clicks!

2. MATCH & REVIEW

Speak with an experienced Advisor for Business Financing and be paired with one or more suitable lenders from our network of over 75 options.

3. GET FUNDED

Acquire funding quickly, within a few hours, and refocus on growing and expanding your business operations.

What is the Simplest Method for Obtaining a Business Loan?

Applying at a bank may not be the easiest option, but there are many other small business lenders to choose from, which can make finding the right one a confusing process.

National simplifies this by offering an industry-leading online marketplace that brings the best lenders together in one place, making it easy for you to compare options and choose the right loan.

The entire process is electronic, so you don't need to take time off for a meeting, and you can submit required financial information online.

LET US HELP YOU BY CALLING NOW!!

CALL (240) 650-8364 | Gloria@andelafinancialservices.com

CALL NOW! TAKE THE FIRST STEP TO A NEW LIFE AND MAKE YOUR FINANCIAL DREAMS A REALITY TODAY.

Ask us about our Commercial & Business Funding

RESOURCES

FOLLOW US:

Copyrights © Andela Financial Services - All Rights Reserved 2023

Disclaimer: The information and insights in this article are provided for informational purposes only, and do not constitute financial, legal, tax, business or personal advice from Andela Financial Services and the author. Do not rely on this information as advice and please consult with your financial advisor, accountant and/or attorney before making any decisions. If you rely solely on this information it is at your own risk. The information is true and accurate to the best of our knowledge, but there may be errors, omissions, or mistakes.